Important Insights:

- The European style industry registered the equivalent of 6 years’ expansion in on the net browsing penetration, climbing from 16 % of complete revenue in January to 29 p.c in August.

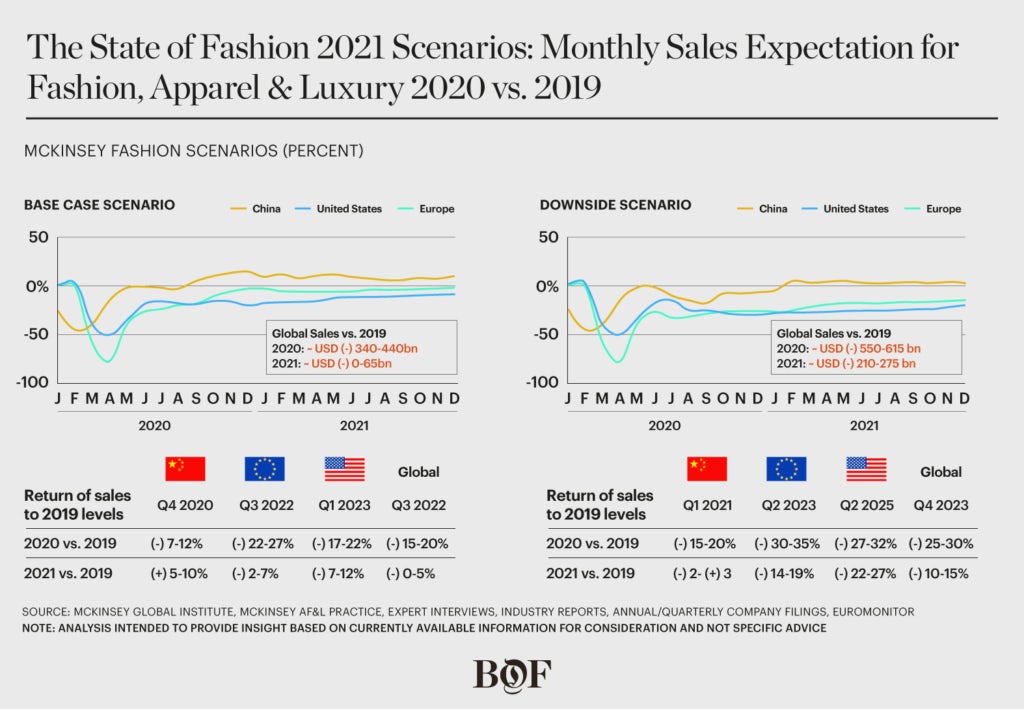

- Revenue volumes in China could return to pre-disaster amounts as quickly as the fourth quarter of this yr.

- World-wide fashion revenue are unlikely to return to 2019 amounts before the 3rd quarter of 2022. Any delay to a extensively obtainable vaccine could drive this again to the fourth quarter of 2023.

In retail retailers, company offices and during world wide supply chains, the Covid-19 disaster has devastated the world wide fashion market. For several providers, the unavoidable shakeout of the sector will be challenging, and not everyone will survive. These are some of the conclusions from exclusive new analysis from The State of Trend 2021 report by The Business enterprise of Vogue and McKinsey & Enterprise.

To develop an early perspective on how the field will fare in the subsequent period of the quick-switching Covid-19 disaster, McKinsey & Company’s Attire Trend & Luxurious Team has spoken to more than 100 specialists and senior executives globally, crunched a thorough established of enterprise studies and surveyed shoppers close to the world.

There continues to be, of program, monumental uncertainty in excess of the two the wellbeing and economic results of the disaster, but by forecasting the small- to mid-phrase economic impact and drawing up possible eventualities for the recovery of gross sales to 2019 ranges, this new evaluation gives some early and essential assistance for the sector in progress of the our total report, which will be launched at VOICES, BoF’s annual gathering for large thinkers, which will be held practically from December 1 to 3, 2020 for BoF Skilled members.

Income Collapse

The collapse of style sector revenues all around the planet this yr has been unprecedented. In Europe, much more than 40 p.c of buyers have used much less revenue on clothes owing to standard and private economical concerns and because they feel a lot less will need to buy garments now they are at house considerably much more than ever prior to.

Now, when people do devote money on manner, their alternatives have develop into disproportionately motivated by product or service good quality, practicality, comfort and worth for income, with trendiness and design and style slipping reduced in precedence, resulting in a marked shift to essential and everyday-have on merchandise. In reality, following a deep, unavoidable initial dip at the outset of the disaster, sales in these groups are just about back to pre-crisis levels. This is in sharp distinction to formalwear and unique occasion garments, which has recovered to only 25 p.c of final year’s revenue, in accordance to a the latest McKinsey European client survey.

In total, global trend revenues ended up 34 percent lower in the quarters noted in April, Could and June 2020 than the very same quarter in 2019, and the business is predicted to get rid of amongst $340 and $440 billion this yr. An assessment of the harmony sheet framework of European shown firms in the trend sector reveals that up to three quarters of players would probable not endure without government support schemes. Assuming that these subsidies will not continue on indefinitely, assessment by McKinsey predicts that 20 to 30 p.c of companies in the global fashion sector are predicted to go bust or be acquired by the largest and strongest providers.

This shakeout is currently happening. Given that the disaster started off, vogue providers in Europe and the US — including Neiman Marcus & J.Crew in the US and Debenhams in the United kingdom — with a put together annual income of $50 billion have submitted for personal bankruptcy or are restructuring using authorities-backed insolvency processes.

Now is the time for executives to make daring conclusions to get by way of these stormy seas.

“With several locations across the globe now going through a 2nd wave of the pandemic, we expect market disruption to keep on in 2021, with world-wide restoration not developing until the latter fifty percent of 2022 at the earliest,” stated Dr Achim Berg, global leader of the Clothing, Style and Luxurious Team at McKinsey. “Now is the time for executives to make daring decisions to get through these stormy seas, no matter whether they are about channel strategy, geographic concentration, assortment setting up or securing provide chains.”

Charting the Highway to Restoration

The condition might be better now than several feared through the original outbreak, but supplied the ongoing spread of the virus and the financial affect of authorities help actions, vogue corporations require to keep on to program for a assortment of scenarios in order to make essential selections to safe their upcoming.

As Covid-19 shut down town centres, on line style income surged.

In April, McKinsey surveyed far more than 2,000 executives to get their views on the pace and extent of the world wide economic recovery. Their predictions had been gloomy, expecting GDP in the third quarter of 2020 to be all over 12 p.c lessen than the similar quarter final yr. The truth nowadays is lousy, but not that undesirable — GDP has fallen by around 5 per cent, which was on the more optimistic close of the executives’ predictions.

There ended up also other indicators above the earlier couple months that assistance to provide a watch into how the disaster may enjoy out from listed here. As Covid-19 shut down metropolis centres, on the internet style profits surged. In just 8 months, the marketplace registered the equivalent of 6 years’ growth in the penetration of on the internet searching. On line income rose from 16 per cent of whole product sales in January to 29 percent in August, with Germany, the British isles and Nordic nations around the world driving substantially of the advancement and similar traits of accelerated digitisation noticed in Asia and the US. Some organizations have claimed double- or even triple-digit advancement in their on-line organizations.

In just eight months, the marketplace registered the equal of six years’ growth in the penetration of online searching.

Many stores and makers have proved how flexible and agile they can be in scaling up their on the web channels — attributes that will be essential about the subsequent few of several years. While the adoption progress curve of on line procuring will ultimately slow, the all round development really should broadly maintain. Additional than 50 percent of customers surveyed in early September stated they planned to store a lot less in bodily shops put up-lockdown, especially whilst Covid-19 measures make the practical experience fewer pleasurable.

But what will occur when social distancing actions are comfortable and outlets are appropriately re-opened? In the months following lockdowns ended up lifted in locations about the planet, product sales bounced again more promptly than predicted. Buyers who, acquiring been deprived of the prospect for so long, eagerly returned to their favorite shops in high quantities. The launch of this pent-up desire has intended that there have even been weeks where, for some vogue suppliers, revenue have returned to 2019 ranges.

This dynamic was to start with noted in China in early May well and has later on replicated in Europe and — to a lesser degree — in North The united states, but it is even now much from crystal clear that these early signals of recovery position to a quick return to pre-crisis paying. The major concern is what will transpire now that the summer season is more than in the northern hemisphere.

McKinsey Fashion Eventualities evaluation by the McKinsey World wide Institute in conjunction with Oxford Economics suggest that world wide manner revenue are unlikely to return to 2019 stages in advance of the 3rd quarter of 2022. Any delay to a extensively accessible vaccine could push this back again to as late as the fourth quarter of 2023. But these estimates mask the actuality that there will be regional and current market-level winners and losers, with the disaster exacerbating pre-current tendencies in the sector, as perfectly as stark variations in functionality concerning marketplaces. What is extra certain is that restoration everywhere will be pushed mainly by on-line revenue. Offline profits are predicted to recuperate absolutely only once a vaccine turns into broadly out there.

The China sector is very likely to recover by the stop of Q4 2020, while Europe and the United States will consider more time.

In Europe, development is probably to be on par with the world wide average, returning to 2019 degrees only by late 2022. There will be gross sales spikes from holiday getaway-time procuring and Black Friday in 2020, all through which income could rival final year’s stages, but the all round craze is one particular of slow recovery. If a 2nd round of lockdowns just take maintain, then the forecast is inevitably even worse, with product sales still down by most likely 30 to 35 % this calendar year.

For the luxurious sector specifically, European retail has been an critical driver of advancement. As Chinese travellers in particular carry on remain at house, revenue in the European luxurious sector are predicted to fall even even further, by 40 to 50 p.c by the stop 2020, with directionally comparable drops anticipated in the US. These developments are unlikely to reverse just before worldwide travel returns to its pre-crisis degrees.

The narrative is very diverse in China, the place luxury buyers are paying at residence, serving to to push a a lot quicker restoration. By the close of the year, luxury gross sales in China could be 8 to 13 per cent bigger than in 2019, in accordance to McKinsey Trend Situations. Big shopping events these types of as Singles Day on November 11, 2020 and Chinese New Yr on February 12, 2021 will probably see distinctive spikes in on the web gross sales. In individual, on the net marketplaces — such as Tmall and Taobao — should really execute particularly effectively as they reward from rising demand from customers and increased supply, as retailers consider to transfer their excessive stock.

In the US, the impact of the disaster on the style sector was initially significantly less significant than in other regions, as lockdowns had been carried out later and the nationwide distribution of stimulus cheques propped up customer shelling out. Even so, even with a second stimulus cheque anticipated in the fourth quarter, the lengthy-phrase recovery is very likely to lag behind that of China and Europe, with a base situation situation restoration timeframe not predicted right up until the 1st quarter of 2023, or as late as the second quarter of 2025 with a far more conservative outlook.

This lagging US recovery can be attributed to dampened purchaser sentiment extending into 2021, with whole manner income in 2020 down 17 to 22 per cent vs . 2019 in a foundation case scenario. The getaway time is not envisioned to offer the very same uplift in the US as in Europe, as organization parties, charity functions and other huge gatherings are cancelled or transfer on the net, negating — or at the very least minimising — the require to expend revenue on new garments. Total recovery to pre-disaster degrees is expected no earlier than the very first quarter of 2023 — a delayed recovery when compared to Europe or China.

Although there are nonetheless grounds for optimism in some fashion sub-sectors, channels and marketplaces, demand from customers will remain subdued perfectly into 2021 and there will be inescapable casualties along the way. Only all those businesses that are versatile and responsive in their decision-earning and who mirror consumer sentiment in their products choices will be poised to seize the development opportunities that arise.

If you are now a member, sign-up for VOICES listed here.

For senior executives who want to go further, a VOICES 2020 Government Move will give you obtain to a unique awareness pack, including a actual physical copy of The State of Manner 2021, bespoke networking options and a a lot more immersive VOICES experience.